This page sets out some basic information about economic inequality in New Zealand. For a more detailed account, embedded in a wider narrative about how inequalities have reshaped this country, see the Books page. References at bottom of page.

What is inequality?

There are many kinds of inequality – of gender, ethnicity, sexuality, and so on. This site focusses on inequality of income and wealth, sometimes known as economic inequality or resource inequality because income and wealth are both things (resources) that the economy produces.

Income is the money that comes in week to week or month to month, while wealth is people’s stored up assets, like houses, KiwiSaver investments, or cash in the bank. Income is what people need to get through the present, while wealth allows them to plan for the future and make investments.

Income and wealth inequality is about who gets what – the fact that some people have much more or much less of these things than others.

Why this kind of inequality?

Income and wealth aren’t the only things that matter for a good life and people’s ability to pursue their dreams and participate in society. But they do make a big difference to the kinds of lives people can lead: individuals with sufficient income and wealth are much better able to pursue their dreams, and achieve their ambitions, than those without. Large income and wealth imbalances can drastically change the nature of a society, making it more divided, less cohesive and connected, and more unhealthy and how healthy and connected it is. So it matters how income and wealth are shared out.

How are the terms defined?

Income inequality is usually calculated based on after-tax income (since that’s what people can actually spend) and on a household basis (since people spend money as part of a larger family unit, in most cases).

For wealth inequality, the measure is individual (or sometimes household) net worth, which is someone’s assets (what they own) minus their liabilities (their debts, or what they owe).

How unequal is New Zealand?

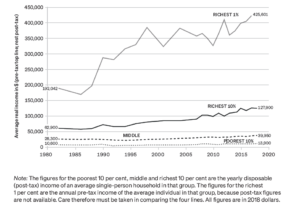

In New Zealand, income (and probably wealth) was being shared out more and more evenly from the 1950s up until the 1980s – but for the next two decades we had the developed world’s biggest increase in income inequality . (More information on the history of inequality in New Zealand is available here.) As the graph (at left) shows, the average income (before tax) of someone in the richest 1% has doubled, from just under $200,000 to over $400,000. In contrast, the average disposable (after tax) income for someone in the poorest 10% is only one-third higher than it was in the 1980s. (Rashbrooke, 2021, p.50.) Some New Zealanders have enjoyed income gains far in excess of their contribution to society (which does not appear to have doubled in recent decades), while many others struggle to pay their bills and lead a decent life. (Survey issues mean there is no after-tax income data for the richest 1%. If it were, the line for the 1% would be lower than shown. However, the basic trend of a doubling of income would remain, and might even be greater, given that taxes levied on the 1% have fallen during this period.)

. (More information on the history of inequality in New Zealand is available here.) As the graph (at left) shows, the average income (before tax) of someone in the richest 1% has doubled, from just under $200,000 to over $400,000. In contrast, the average disposable (after tax) income for someone in the poorest 10% is only one-third higher than it was in the 1980s. (Rashbrooke, 2021, p.50.) Some New Zealanders have enjoyed income gains far in excess of their contribution to society (which does not appear to have doubled in recent decades), while many others struggle to pay their bills and lead a decent life. (Survey issues mean there is no after-tax income data for the richest 1%. If it were, the line for the 1% would be lower than shown. However, the basic trend of a doubling of income would remain, and might even be greater, given that taxes levied on the 1% have fallen during this period.)

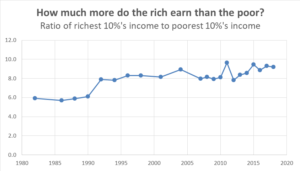

The graph at left shows another way to put it: someone in the richest 10% used to earn five-six times as much as someone in the poorest 10%, but now they earn nine times as much. (Data from Perry, 2019, p.314.)

Wealth – houses, businesses, cars, financial investments – is even more unequally distributed than income. In New Zealand the wealthiest tenth own one-quarter of the country’s assets, while the poorest half of the country has just 2 per cent. (Rashbrooke, 2021, p.52.) That leaves many people in poverty, lacking the resources they need to participate in society and follow their dreams.

What is the connection with poverty?

Inequality connects both ends of the spectrum, wealth and poverty, and argues that they have to be looked at together. The fundamental issue is distribution: how are the economy and society structured, and where do they deliver their rewards?

The structure of the economy, in turn, rests on a series of beliefs. In a more individualistic world, the belief that encourages governments to do relatively little about poverty – namely, that people are poor because of their own bad choices – is the same that discourages governments from asking the wealthy for a larger tax contribution (i.e., that would be punishing ‘successful’ people).

Conversely, in a more community minded world, people believe that others are poor often through no fault of their own, whether because of ill health, difficult upbringings, discrimination, or simple bad luck. In this world, people also believe that society is stronger, and everyone better off, if the government shows generosity and compassion towards those who are struggling, and does more to help them get back on their feet.

In these situations, governments will also ask for a greater tax contribution from wealthy people, who may well have worked hard but will have also benefited from luck, fortunate upbringings, and the public services that governments provide. In other words, wealth and poverty are ultimately generated by the same belief systems.

In policy terms, too, poverty doesn’t exist in isolation: people are poor, in part, because the economy directs much of the country’s resources to those who are already doing well. For instance, within a company, pay for ordinary staff can be low because so much of the company’s income goes to senior management and shareholders. That low pay translates into poverty: roughly four in ten children living in hardship have a parent in full-time work. Wealth and poverty are generated by the same forces.

Addressing poverty also requires increases in government support, through welfare payments and public services like health and education, which are funded out of taxes. That in turn requires a greater tax contribution from those who can most afford it, the wealthiest New Zealanders, many of whom – according to Inland Revenue research – pay less of their income in tax than people on the minimum wage. A failure to tax wealthy people fairly results in insufficient revenue to address poverty. Again, the two ends of the spectrum are connected.

Are people worried about inequality?

Opinion polling shows roughly 70% of New Zealanders believe income disparities are too large. Four out of five believe the effects of widening inequality have been negative. When given the chance in surveys, most New Zealanders opt for a much more even distribution of wealth than the current one. Only a quarter of New Zealanders oppose government action to reduce inequality. (Rashbrooke, 2021, p.194.)

What are the impacts of inequality?

For some people, inequality is fundamentally unfair: if people get such very different rewards for their work, there must be something wrong. There are also practical reasons to be concerned about inequality.

Unequal societies are less functional, less cohesive and less healthy than their more equal counterparts. The damage inequality does falls under five headings: trust and cohesion; health; opportunities; open politics; and the economy.

When it comes to trust and cohesion, in an unequal society, people lose touch with how ‘the other half’ lives. Growing income imbalances breed distrust and eat away at the bonds between people, weakening our sense of each other’s lives and our ability to pull together to tackle difficult problems. On the health front, more unequal societies are more materially competitive, more hierarchical and more stressful. This leads to higher rates of stress-related illness. (Wilkinson and Pickett, 2010.)

Opportunities are damaged as well: inequality means that people’s incomes are substantially pre-determined by who their parents were. In a society like America, you can predict half of a person’s income from what their parents earned, because huge inequality leads to such different starts for rich and poor kids and the government doesn’t offer much support for adults. Advantage and disadvantage are passed on from generation to generation.

In contrast, in more equal societies like Denmark, nearly all parents have enough income to, for instance, buy their kids a computer for school and heat their home properly, and strong public services help out those struggling in later life. People can make their own way in life rather than being heavily influenced by their parents’ status: just 15% of a Dane’s income can be predicted from their parents’ earnings. When the equivalent figure for New Zealand was calculated some years ago, it was estimated at 30%, somewhere in between these two extremes – but as inequality’s effects become entrenched, New Zealand may be starting to look more like America. (Rashbrooke, 2021, p.164.)

When it comes to politics, inequality allows wealthy people to influence politicians, who rely on them for donations to fund their campaigns. That means some people get more access than others – a violation of the ideals of democracy.

Finally, when it comes to the economic growth, OECD and IMF research suggests that more unequal countries have worse economies, because poverty deprives them of the full talents of some children, and asset bubbles and instability become more prevalent. (Rashbrooke, 2018, pp.15-16.)

In these five areas, the failings affect all of us, no matter where we are on the spectrum.

What causes inequality?

Inequality has many causes, and they vary from country to country. In New Zealand, its causes include the impacts of colonisation on Māori, including the alienation of 95% of Māori land, and ongoing racism and discrimination.

Other factors like global trade agreements play a role, by shifting manufacturing and other jobs to countries with lower pay. But many of the causes are purely domestic. In New Zealand, in the 1980s and 1990s, taxes were cut for top earners (falling from 66% to 33%), while benefits were reduced by roughly one-quarter for the poorest families. Thousands of people lost their jobs as state-owned enterprises were sold off hastily, and the number of people in trade unions – which traditionally pushed up the wages of ordinary workers – fell from 70 per cent of the workforce to 20 per cent. (Rashbrooke, 2021, pp.47-48.)

In addition, some inequality is down to things like household types (New Zealand has more single parent families than before, and they tend to be poorer), though these factors are probably not as important as those above.

When it comes to wealth, the 1980s and 1990s sales of public assets will have increased the wealth of those at the upper end, while, more recently, declining home ownership increases disparities between owners and renters. Data shows that saving money – a key way to build up wealth – is very difficult except for those who are high earners or derive their income from property. (Rashbrooke, 2021, p.53.)

More information

Detailed answers to specific questions can be found on the right-hand side menu on this page.

To read the full account of inequality in New Zealand, see the Bridget Williams Books ‘Inequality’ series. Details here.

You can also see where you sit on New Zealand’s income spectrum using the Inequality Calculator. Find out how much you earn compared to your fellow citizens here.

References

Perry, Bryan, Household incomes in New Zealand, Ministry of Social Development, Wellington, 2019.

Rashbrooke, Max (ed.), Inequality: A New Zealand Crisis, Bridget Williams Books, Wellington, 2018.

Rashbrooke, Max, Too Much Money: How Wealth Disparities are Unbalancing Aotearoa New Zealand, Bridget Williams Books, Wellington, 2021.

Wilkinson, Richard, and Pickett, Kate, The Spirit Level, Allen Lane, 2010.