In the arguments about how wealth and income are shared out, one of the common lines is that poverty matters, but inequality, in the sense of the gaps across all of society, is a distraction. This is usually buttressed with a reference to China: just look, people say, at the way that hundreds of millions of people have been pulled out of poverty, even as the gap between the rich and the rest has widened. Inequality doesn’t matter; fostering economic growth is the key.

This week’s report from Oxfam – the one pointing out that 62 billion years have as much wealth as half of the world’s population combined – neatly destroys that argument.

It acknowledges that, between 1990 and 2010, the number of people in the world living below the extreme poverty line halved. But, crucially, it also points out:

Yet had inequality within countries not grown during that period, an extra 200 million people would have escaped poverty. That could have risen to 700 million had poor people benefited more than the rich from economic growth.

The point here is that although countries used some of their economic growth to lift people out of poverty, a disproportionate amount of that growth went to the already rich. Had the growth been fairly shared, poverty would have fallen even more.

The reason that growth wasn’t shared fairly is to do with inequality: the failure to curb monopolies that benefit the wealthy; a lack of bargaining power for workers that sees them unable to claim their share of company profits; weak tax and benefit systems that don’t provide an adequate safety net or recognise the gains everyone gets from public infrastructure; corruption and other ways that wealth influences power. Underlying all that are attitudes about inequality – beliefs that some people are more deserving than others.

So, yes, you may need economic growth to lift people out of poverty; but if you don’t think about how it will be shared, it’s going to be severely limited in its effectiveness. Shared economic growth is a key challenge of the years ahead – and that forces us to think about inequality.

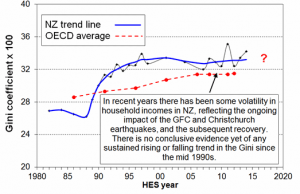

s that inequality is not increasing. The Household Incomes Report, which is quite rightly cautious, continues to say there is no “conclusive” evidence of rising inequality. But as the graph (at left) of the Gini coefficient shows (in which 0 is perfect equality and 100 is perfect inequality), it is starting to look like an upward trend, and the Report says that one more year of data at this level will be enough for it to conclude that inequality is indeed rising.

s that inequality is not increasing. The Household Incomes Report, which is quite rightly cautious, continues to say there is no “conclusive” evidence of rising inequality. But as the graph (at left) of the Gini coefficient shows (in which 0 is perfect equality and 100 is perfect inequality), it is starting to look like an upward trend, and the Report says that one more year of data at this level will be enough for it to conclude that inequality is indeed rising.